4 Proven Ways to Take Care of your Finances

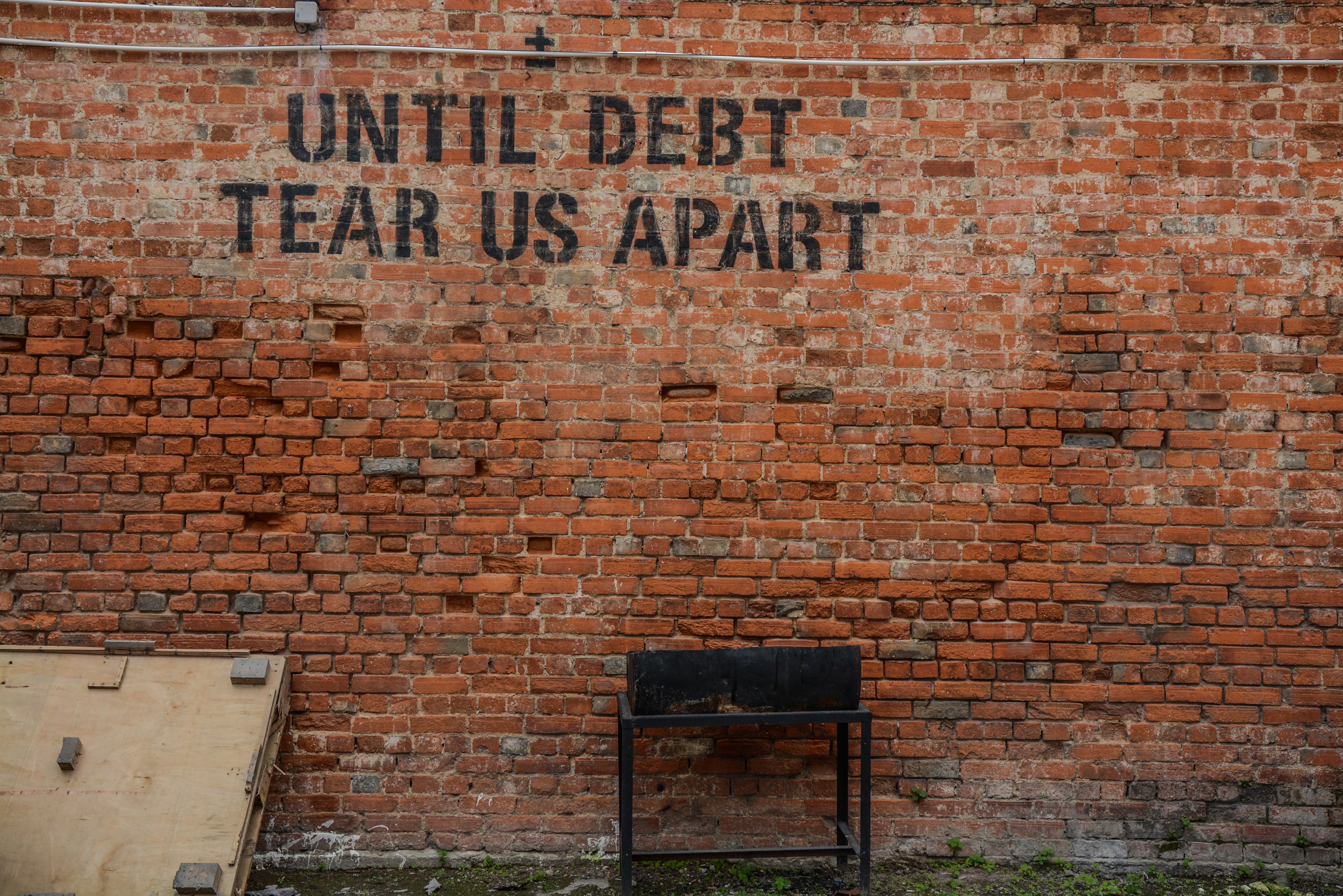

During the pandemic, how do you take care of your finances? Where are you able to handle your debt and loan? How do you financially survive?

I have my personal ways to handle my debt and finances since this happened to me before and the struggle is real. There are times that you need to pay your debt monthly or quarterly and you need to check what needs to pay first.

If you need to have debt and loan; you need to embrace the interest and other fees and charges included. That’s the reason why loan companies gain a lot of income from borrowers. Imagine the interest rate they added on your loan and when you compute it, they will get almost half of the money that you loan from them. Crazy right?! Yes, it’s crazy but it’s true. So next time, before you get into debt and loan, remember these tips so you will not be broke.

I listed 4 proven ways to take care of our finances. I actually used these tips and still using them. It may work for you too!

1. Save your salary

If you have some cash and savings and you think you can spend them immediately, might as well think and save first because we can’t tell when we need it most. No need to buy expensive clothes or gadgets that you don’t really use. Instead of you using it for leisure, just save it. As financial gurus said – money is not permanent. You can have it now but sometimes difficult to regain it.

2. Control your leisure

You should know by now what is your commodities and leisure. Might as well save it to the bank or invest. Some of my friends even put their money into stocks. You will have your shares and in a long run, you might get your money double or triple. Who knows?!

I remember when I was in college; I have some spare money from my salary and instead of me saying it – I tried to buy a new mobile phone which is not necessary. After a week; my finances are already tight and instead of keeping the mobile phone, I sell it to my friend half the original price.

3. Debt Management

If you have a student loan or bank debt, at least save even 10% or 20% of your income so you can pay it in advance. Better to have savings than nothing. Once you’re free from debt; now is the time to manage your finances and don’t go back from being broke.

4. Move toward eliminating it completely

Eliminating debt is not easy because there are still circumstances that you might still borrow money from any lending companies or banks. But how can you eliminate debt? Control your finances and have a list of the things that’s really necessary. Buying clothes monthly or every payday is not important. Don’t be so materialistic and show off to your friends that you can do all those things. Better being humble and buy things that we really need the most.

You don’t need to buy appliances and gadgets if you can still use them. It is better to be debt-free than thinking about the loan you have for a year or even 3 to 5 years from now.

Learn more tips on how to avoid debt and take care of your finances.